How has Bet365 maintained a consistent top position in online gambling? Tom Waterhouse reviews its tactics for success.

Becoming the dominant force early in an industry can lead to significant competitive advantages, brand recognition, and customer loyalty. Amazon in ecommerce and Coca-Cola in soft drinks, are examples where early and effective market entry cemented dominant lasting positions. Dominance is maintained through established distribution, economies of scale and a sticky customer base.

In gambling, aside from countries where a pari-mutuel (tote) operator has a monopoly on betting, there is a variety of choice. For example, in Australia, there are around 100 wagering operators and in the UK there are 175 online operators. Before the internet, bookmakers would typically earn and retain market share through physical high street betting shops, which gave the industry a natural barrier to entry.

In the UK, Ladbrokes and William Hill emerged as the initial market leaders among a wide field of operators. By 1999, at the dawn of the internet era, there were 8,500 UK betting shops. As with Amazon, the internet changed the way people shop for bets, leading to a steady decline in high street betting shops. In their place, technology-led operators like Flutter and Bet365 emerged.

Bet365’s humble beginnings

When Denise Coates bought the domain name Bet365.com on eBay for a reported $25,000, she saw an opportunity to transform the family’s small chain of betting shops based around Stoke-on-Trent into a high-tech, online business. Coates’ ensuing strategy, execution and growth was nothing short of extraordinary.

Founded in 2000 with just 12 employees, Coates saw the internet as the future of wagering and sold the family betting shop business by 2005. In contrast, rival betting operators opted to keep a foot in each door, with a dual focus across the nascent internet opportunity and the profitable betting shop business.

Since launching, Bet365 grew rapidly by offering innovative ways to bet and an extensive range of sports, events and casino games. The user experience is intuitive and simple, with customers able to listen, watch and bet in-play with ease.

Widely used features such as early payouts for winning selections, best odds guaranteed, cash outs and multi/parlay boosts are products of Bet365’s leading customer experience innovation.

In-play with Ray

The marketing efforts of Bet365 have attracted and retained a customer base that now stands at 90 million users worldwide. The legendary ‘in-play with Ray’ adverts, featuring actor Ray Winstone, are iconic and highlight Bet365’s leading in-play product.

More recently, Bet365 showcased the attention they pay to every sport through their ‘never ordinary’ curling advert. The ability to watch and bet on live niche sports such as table tennis is something that few other operators can compete with.

Growing global with a localised product

Bet365 holds licences in South America, Europe, Australasia, Canada and a growing number of states in the US. In markets where they have a foothold, content is tailored specifically, with language and product considerations (such as sport popularity).

When commercially viable, Bet365 will move; when not, they will wait (as they did with the US) and, in some instances, they will withdraw. In October 2023 for instance, it withdrew from India due to a 28% goods and services tax.

As we first discussed in May 2021, US online operators have fought for market share by spending up to US$1,000 to acquire customers. Ultimately, some operators have withdrawn from the competitive market, such as Churchill Downs.

“The online betting and casino space is highly competitive with an ever-increasing number of participants… Many are pursuing maximum market share in every state with limited regard for short-term or potentially even long-term profitability”

– Churchill Downs’ CEO, William Carstanjen (February 2022)

JMP Securities estimates 74 companies have entered the regulated US online wagering market since 2018. Of these, 43 (58%) are still operational while 18 (24%) have ceased operations and 10 (14%) have significantly reduced their presence or are in the process of shutting down. Three (4%) have been acquired.

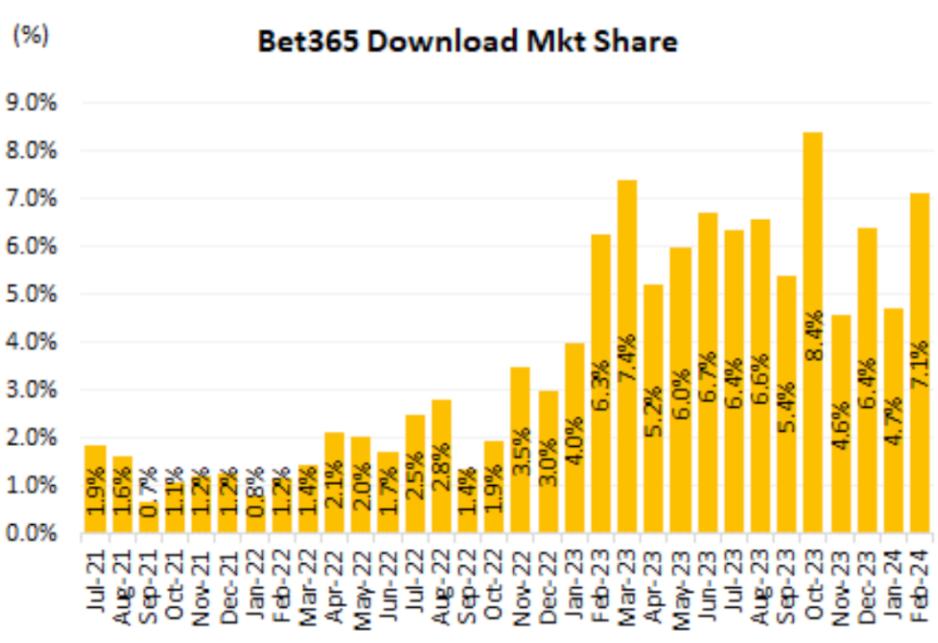

Throughout this highly competitive period, Bet365 patiently remained on the sidelines. The company only expanded out of New Jersey in September 2022, more than four years after the US market opened up, growing quickly to 10 states. Early data reveals the sportsbook’s growing popularity, with total US app download market share over 7%.

| Bet365 legal states | Open since | Licensing partner |

| New Jersey (NJ) | August 2019 | Hard Rock Hotel & Casino Atlantic City |

| Colorado (CO) | September 2022 | Century Casinos |

| Ohio (OH) | January 2023 | Cleveland Guardians |

| Virginia (VA) | January 2023 | Washington Commanders |

| Iowa (IA) | June 2023 | Casino Queen Marquette |

| Kentucky (KY) | September 2023 | Sandy’s Gaming and Racing |

| Louisiana (LA) | November 2023 | Charlotte Hornets |

| Indiana (IN) | January 2024 | French Lick Resort |

| Arizona (AZ) | February 2024 | Ak-Chin Tribe |

| North Carolina (NC) | March 2024 | Charlotte Hornets |

Upping the Stakes

As highlighted in our June 2024 newsletter, emerging wagering businesses have the greatest chance of success if they focus on dominating a niche without a clear market leader. Another privately-owned wagering business which has disrupted the status quo is Stake.com.

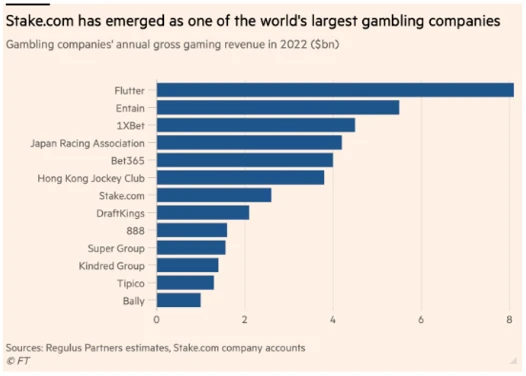

Founded in 2017 by Ed Craven and Bijan Tehrani, Stake has increased its gross gaming revenue 25-fold from $105 million in 2020 to nearly $2.6 billion in 2023 (FT). Stake’s growth has driven Craven’s personal wealth of AU$4.51 billion and his purchase of Melbourne’s most expensive home for $80 million in 2022 (Australian Financial Review).

The success of Stake has been rooted in its ability to appeal to a younger, more tech-savvy demographic. In countries where regulation permits, users can bet using cryptocurrencies, which has revolutionised the online wagering experience.

For Stake, cryptocurrency payments reduce operational expenses tied to conventional payment methods, which means that they can increase technology investments, offer larger bonuses, better promotions and superior odds. In countries where crypto betting is not legislated, Stake has gained market share through engaging streaming content, improved UX and strategic partnerships.

Global presence

Stake has grown its global awareness and built trust through a series of Premier sponsorships and an entry into Formula 1, as the title sponsor of the Alfa Romeo team. The operator has targeted a younger demographic through partnerships with the UFC, where millennials make up 40% of the fanbase (Play Today).

While other operators have retracted their presence from India, Stake has become the first operator to allow customers to deposit in Indian rupees. We discussed the Indian wagering opportunity in March last year. Stake also entered the South American market, acquiring Betfair Colombia in November 2023.

The founders of Stake (headquartered in Australia) recently invested in Australian wagering operator Pointsbet. In May, the Australian Financial Review reported that Stake’s owners had acquired a 5% shareholding in the business.

Stake increasing its shareholding in fully licensed operators such as Pointsbet may signal a broader strategy which parallels Bet365: to operate globally and pay high tax domestically. Last year, the Coates family paid £375.9 million in UK tax and is often cited as one of the UK’s largest taxpayers.

Kicking competition

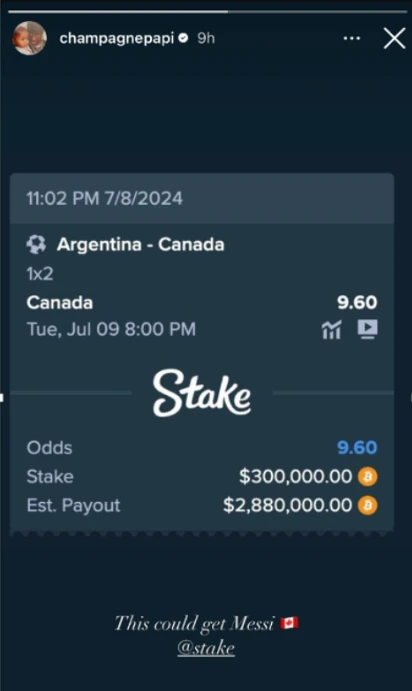

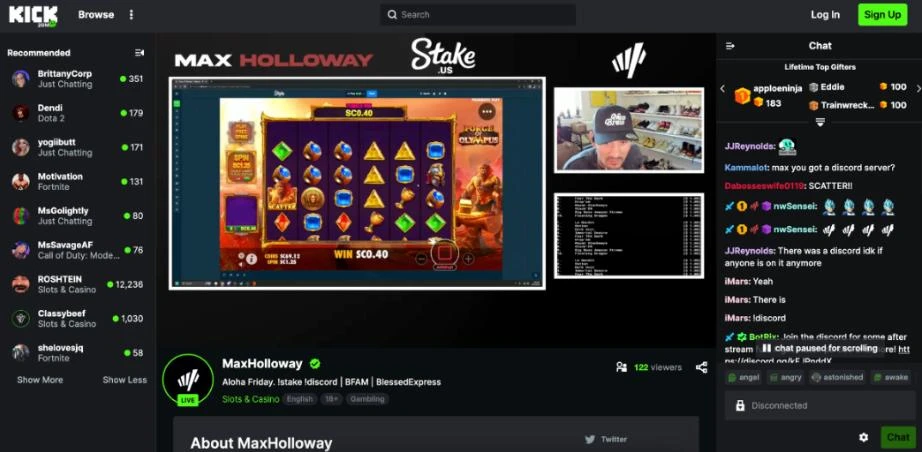

Stake has created vibrant betting communities through partnerships with celebrities like Drake, leveraging streaming technology so that viewers can effectively watch, comment and engage with wagering. Kick, a streaming platform owned by the founders of Stake, was launched in early 2023 and is quickly gaining traction among streamers and viewers alike.

As discussed in our August 2023 newsletter, Kick stands out from other platforms like Twitch due to its supportive stance on betting streams. Since April 2023, Kick’s number of active channels has nearly tripled from around 67,000 to 183,922 (Streams Charts).

As the internet enabled Amazon to disrupt traditional commerce, so too did it allow Bet365 and Flutter to disrupt the traditional wagering model. Twenty years on, Stake is disrupting the incumbent operators through innovation across product, payments and customer engagement.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.